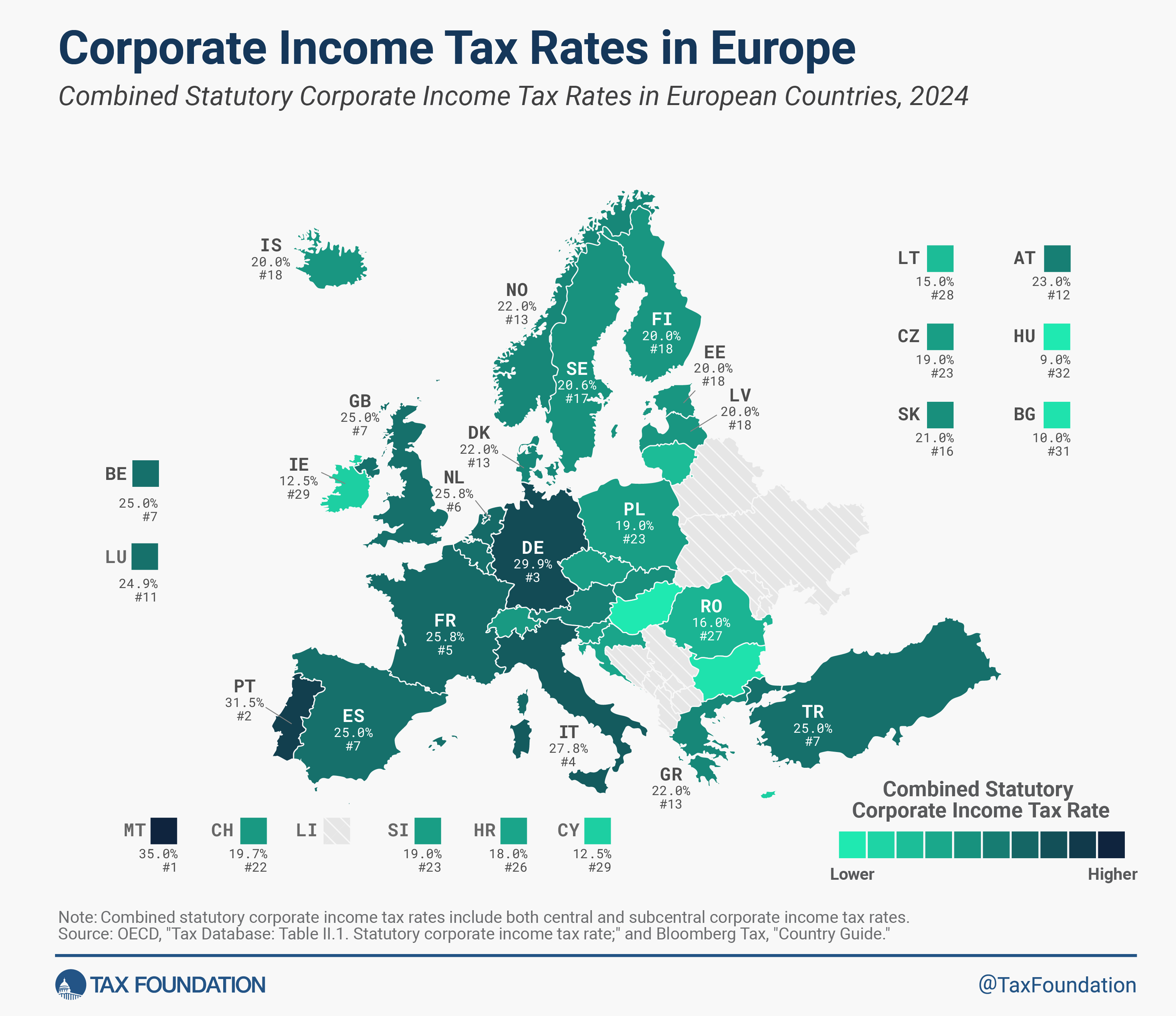

Corporate Tax Rate 2024 Uk. The corporation tax calculator allows companies in the uk and companies based outside the uk with offices or branches in the uk to calculate their corporation tax based on. Marginal relief for corporation tax;

The main rate of corporation tax is 25% for the financial year beginning 1 april 2024 (previously 25% in the financial year beginning 1 april 2023). You pay corporation tax at the rates that applied in your company’s accounting period for corporation tax.

The Standard Rate Of Corporation Tax For Businesses With Profits Of At Least 250,000.00 Will Be 25%.

What businesses can expect from the labour government.

It's Important To Note That This Rate Is Not An Average Rate But Serves As A Transitional Phase Between The.

As we approach the 2024/25 fiscal year, understanding the uk corporation tax and its implications is essential for businesses looking to be more agile with their finances.

Corporate Tax Rate 2024 Uk Images References :

Source: imagetou.com

Source: imagetou.com

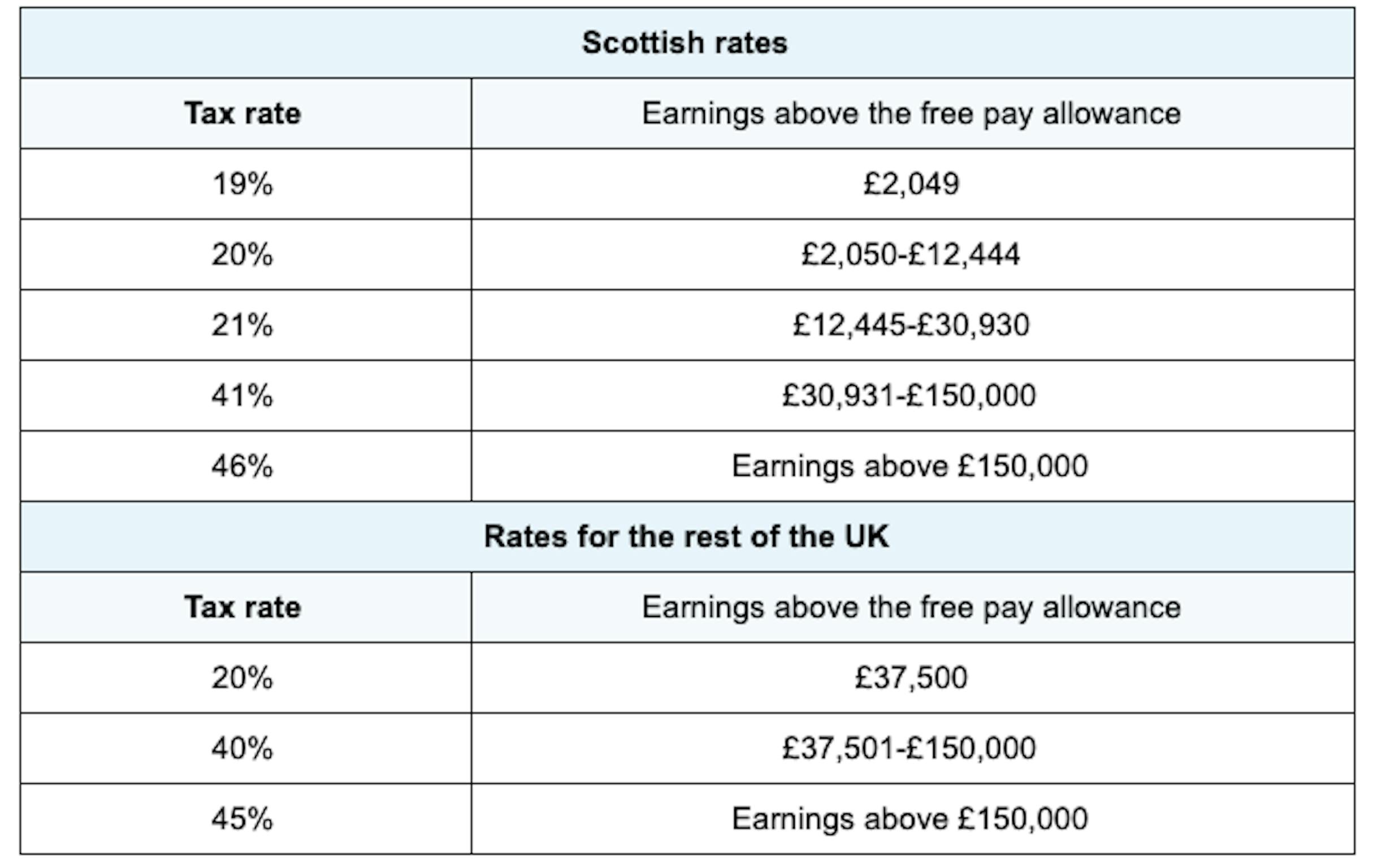

Tax Thresholds Uk 2024 Image to u, The uk corporation tax rate is currentl y 25% for all limited. The corporation tax rate tables has been updated for 2024.

Source: ebbaqmaryjane.pages.dev

Source: ebbaqmaryjane.pages.dev

Uk Corporate Tax Rate 2024 Rasia Catherin, The increase in the main rate of corporation tax to 25% opens up differences in the amount of tax payable depending on the decisions made. For 2024, businesses within the £50,000 to £249,999 profit range face a marginal rate of 26.5%.

Source: justonelap.com

Source: justonelap.com

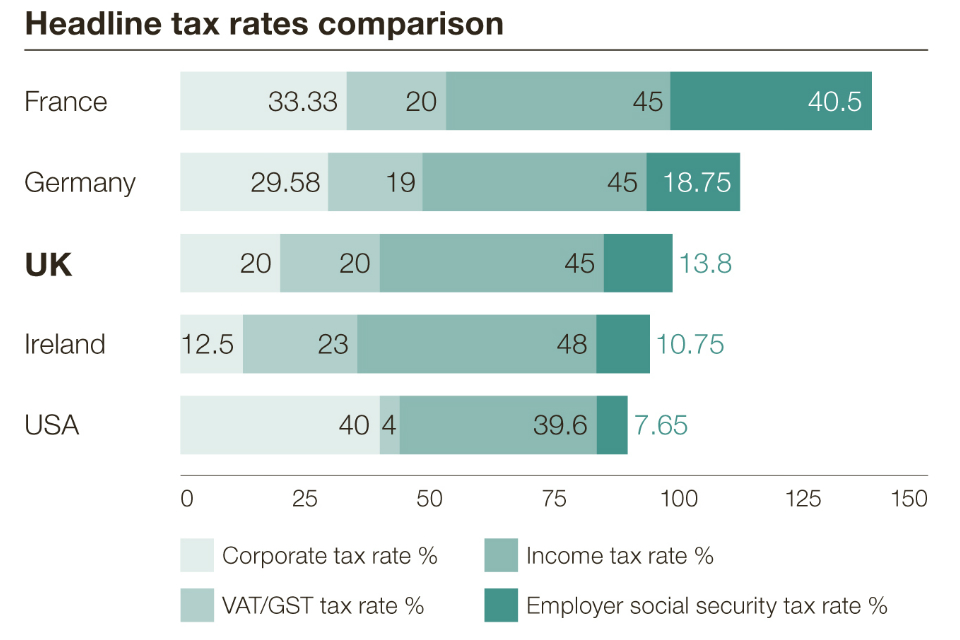

Tax rates for the 2024 year of assessment Just One Lap, Sitharaman proposes to slash import tax on gold, silver to 6%. While the rate had previously been set at 19%, it has now been.

Source: oliaqjuanita.pages.dev

Source: oliaqjuanita.pages.dev

Uk Capital Gains Tax Rates 2024/25 Rona Vonnie, Corporation tax in the uk is a corporate tax levied on the annual profits made by uk resident companies and branches of overseas companies. While the rate had previously been set at 19%, it has now been.

Source: tobeqphillida.pages.dev

Source: tobeqphillida.pages.dev

Uk Tax Rates 2024 Aila Lorena, The corporation tax rate for company profits is 25%. New income tax slabs announced in new tax regime in budget 2024.

Source: theadvisermagazine.com

Source: theadvisermagazine.com

2024 Corporate Tax Rates in Europe, How much of your income. Corporation tax charge and rates from 1 april 2022 and small profits rate and marginal relief from 1 april 2023;

Source: carmaqorelia.pages.dev

Source: carmaqorelia.pages.dev

Corporate Tax Changes 2024 Rheta Charmion, It's important to note that this rate is not an average rate but serves as a transitional phase between the. The standard rate of corporation tax for businesses with profits of at least 250,000.00 will be 25%.

Source: lissabcarolee.pages.dev

Source: lissabcarolee.pages.dev

What Is Corporation Tax Rate 2024 Kimmi Merline, As we approach the 2024/25 fiscal year, understanding the uk corporation tax and its implications is essential for businesses looking to be more agile with their finances. What businesses can expect from the labour government.

Source: en.protothema.gr

Source: en.protothema.gr

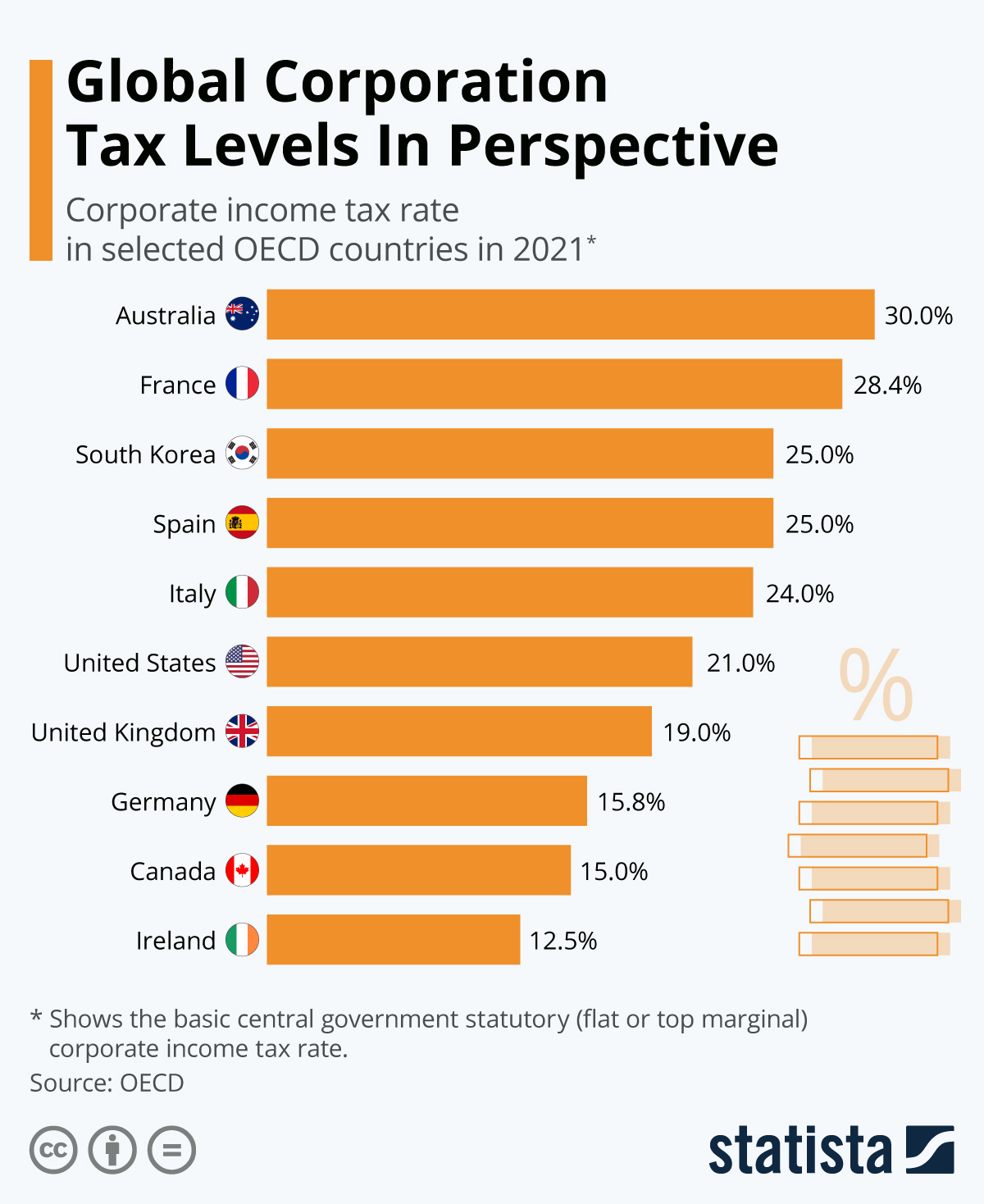

Global Corporation Tax Levels In Perspective (infographic, While the rate had previously been set at 19%, it has now been. The main rate of corporation tax is 25% for the financial year beginning 1 april 2024 (previously 25% in the financial year beginning 1 april 2023).

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, The standard rate of corporation tax for businesses with profits of at least 250,000.00 will be 25%. Added 19% corporation tax rate changes from 2017/18.

Corporate Tax Laws And Regulations United Kingdom 2024.

The corporation tax rate for company profits is 25%.

From 1 April 2023 There Is No Longer A Single Corporation Tax Rate.

What businesses can expect from the labour government.

2024