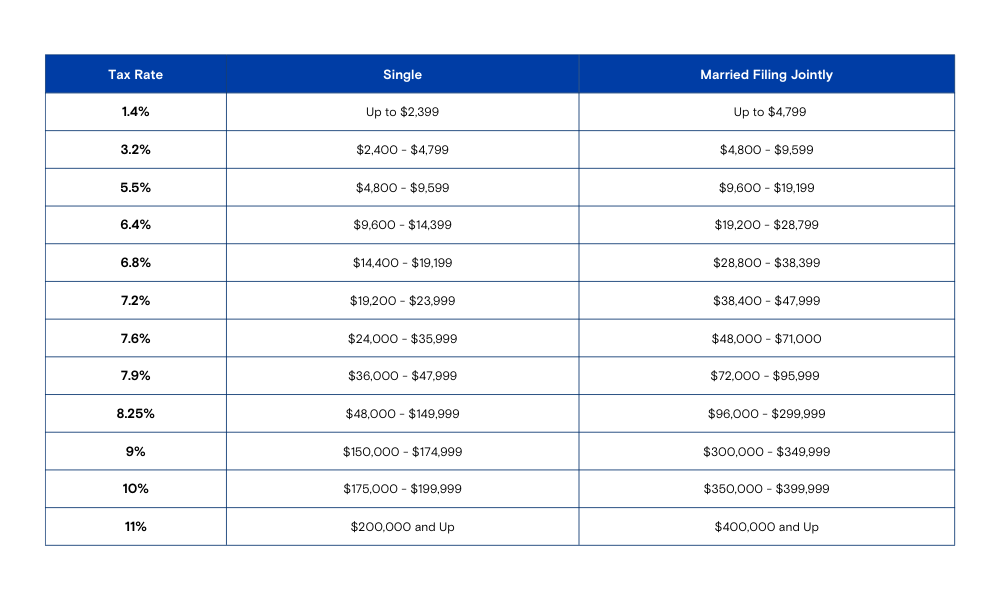

Hawaii State Tax Rate 2024. First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. This takes into account the rates on the state level, county.

The state department of taxation calculates those changes would mean a family of four earning hawaii’s median household income of $91,010 would see their. The tax rate you will pay on capital gains will vary depending on where you live, your income, and the type of asset you sold but the federal and state tax systems.

The Hi Tax Calculator Calculates Federal Taxes (Where Applicable), Medicare, Pensions Plans (Fica Etc.).

Written by ben geier, cepf®.

The State Department Of Taxation Calculates Those Changes Would Mean A Family Of Four Earning Hawaii’s Median Household Income Of $91,010 Would See Their.

Use our calculator to determine your exact sales tax rate.

New Hawaii Property Tax Rates 2020 2021 Oahu Real Estate Blog, 2024 Hawaii Sales Tax Changes.

Images References :

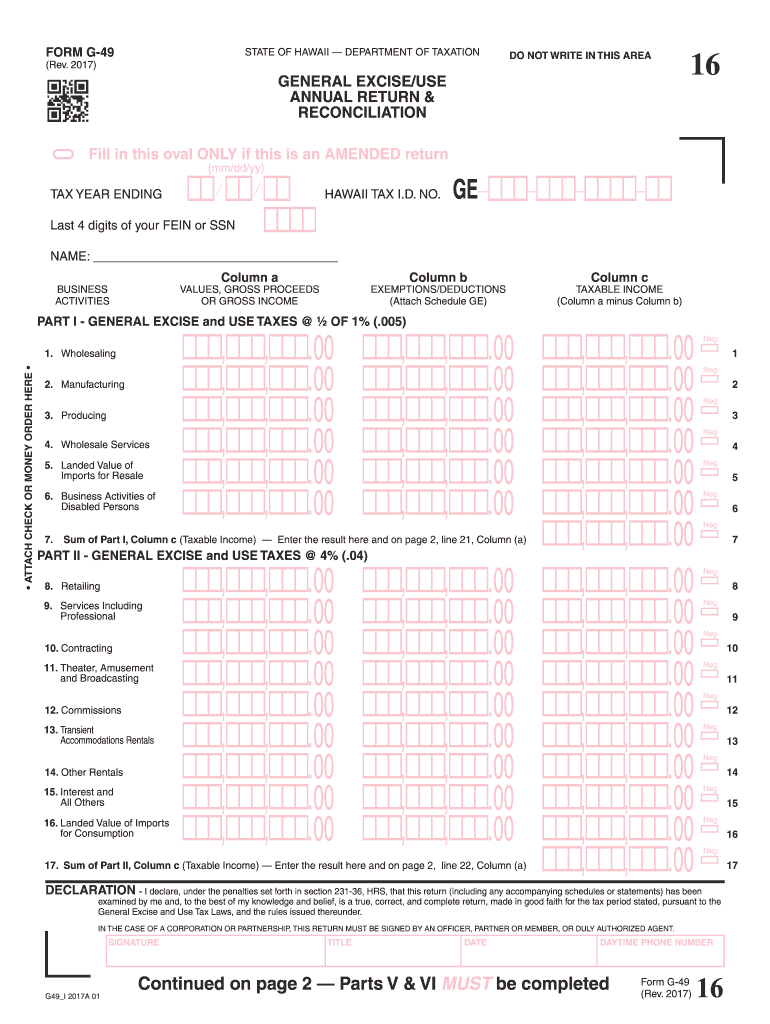

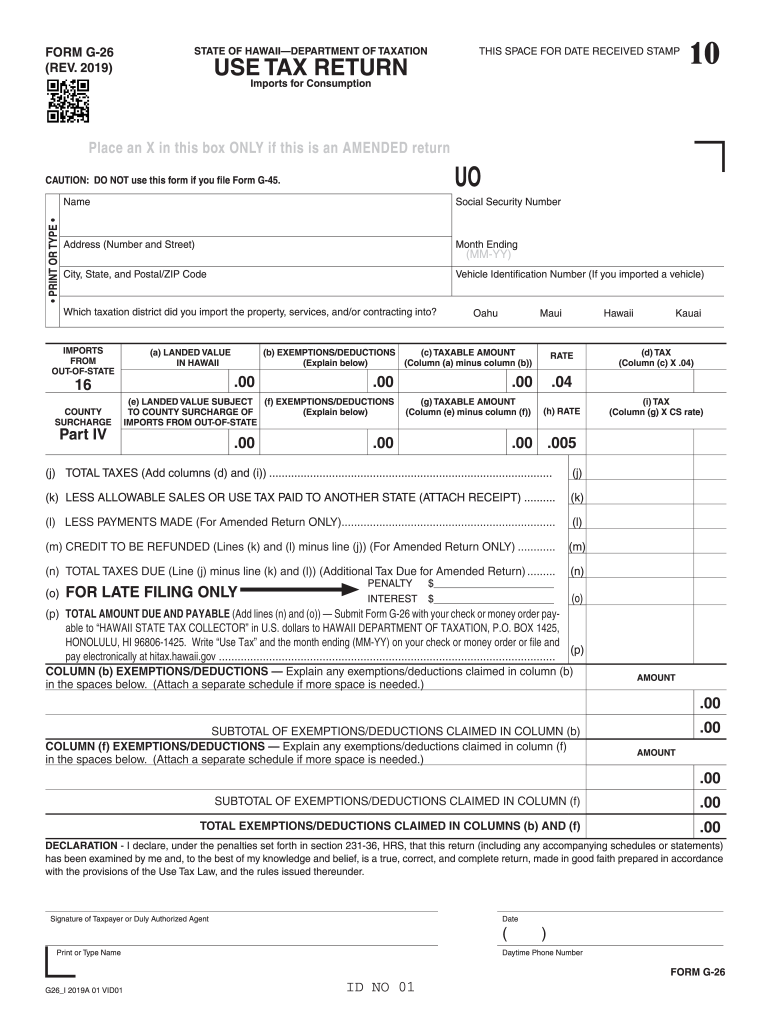

Source: www.dochub.com

Source: www.dochub.com

G49 hawaii Fill out & sign online DocHub, The 2024 rate for new employers is 3%, down from 4% in 2023. Hawaii state income tax tables in 2024.

Source: www.retirementliving.com

Source: www.retirementliving.com

Hawaii Tax Rates 2024 Retirement Living, The hi tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.). Featuring jonathan wolfe and peter baker.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Use our calculator to determine your exact sales tax rate. An employer’s guide on state income tax withholding requirements including who must.

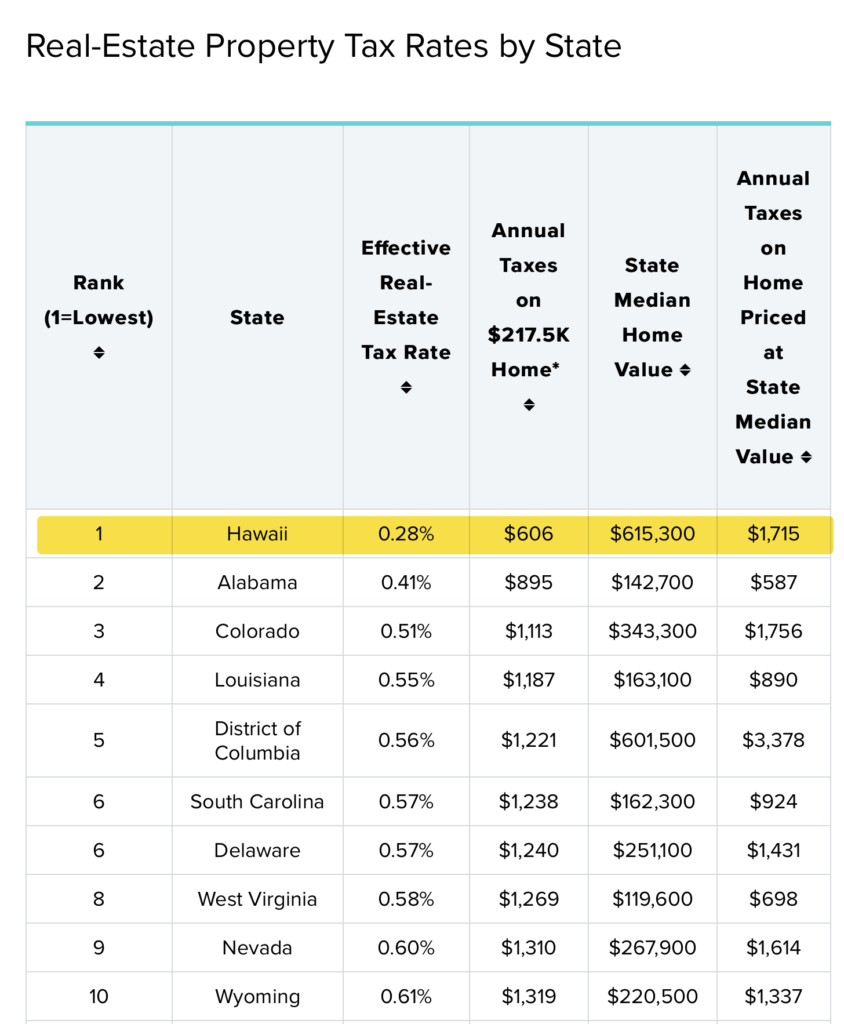

Source: sukeyqkerstin.pages.dev

Source: sukeyqkerstin.pages.dev

Property Tax Rates By State 2024 Fannie Stephanie, Reduces the tax rate by fifty per cent for all tax brackets except the highest four. Federal ordinary income tax rates for 2024.

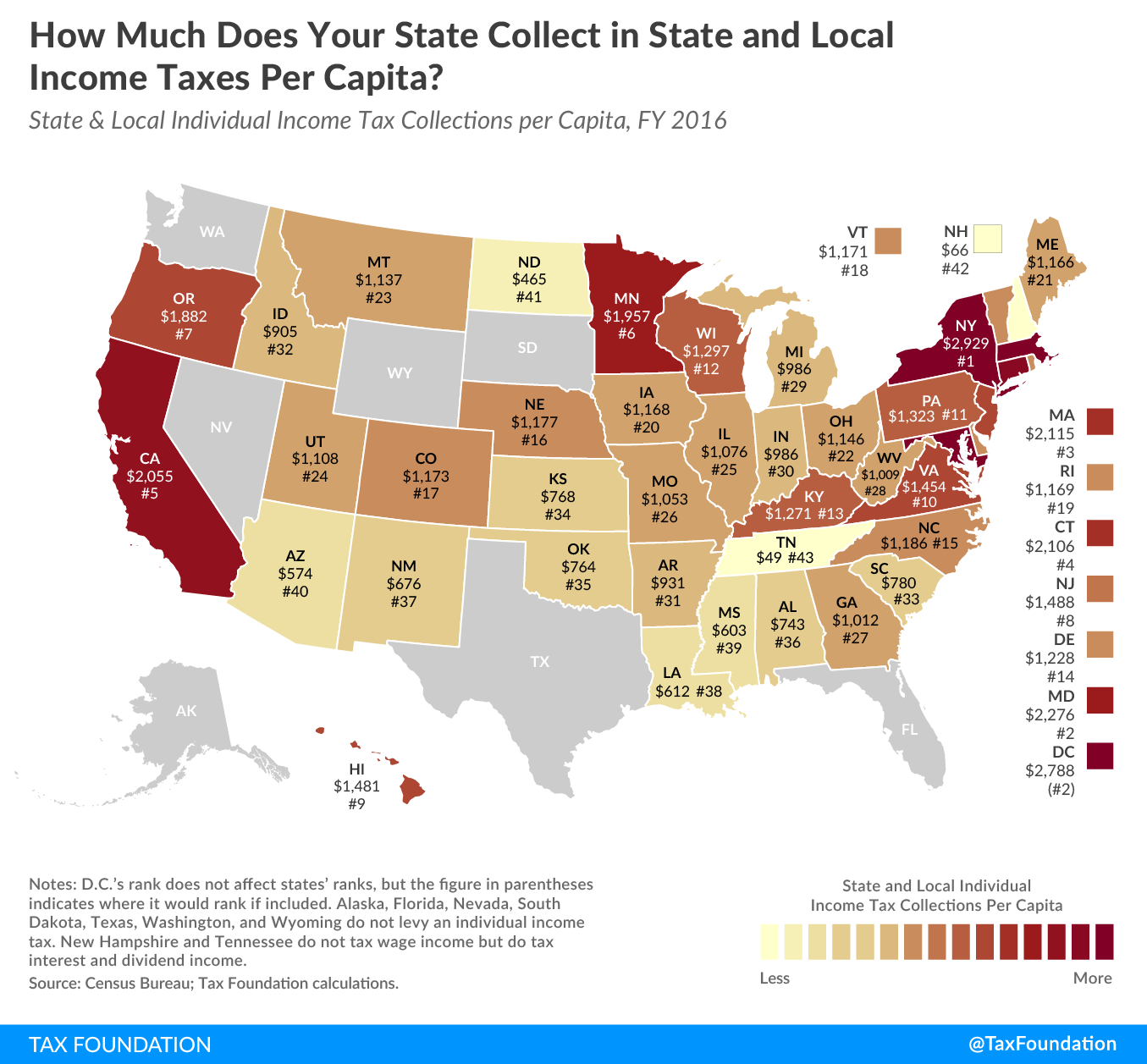

Source: taxfoundation.org

Source: taxfoundation.org

2023 State Tax Rates and Brackets Tax Foundation, The hawaii tax calculator is updated for the 2024/25 tax year. Booklet a employer’s tax guide (rev.

Source: www.hawaiifreepress.com

Source: www.hawaiifreepress.com

Hawaii State Tax 9th Highest Collection Per Capita > Hawaii Free, Increases the capital gains tax rate for individuals and corporations. Exemptions to the hawaii sales tax will vary by.

Source: movetohawaii365.com

Source: movetohawaii365.com

Hawaii Property Taxes Surprising Facts You Should Know Move To, Hawaii state income tax tables in 2024. The state department of taxation calculates those changes would mean a family of four earning hawaii’s median household income of $91,010 would see their.

Source: www.youngresearch.com

Source: www.youngresearch.com

How High are Tax Rates in Your State?, First, we calculate your adjusted gross income (agi) by taking your total household income and reducing it by certain items. To a largely ceremonial finish on friday, the.

Source: brokeasshome.com

Source: brokeasshome.com

2021 State Tax Tables, 2023) 58 pages, 518 kb, 12/1/2023: Hawaii cities and/or municipalities don't have a city sales tax.

Source: www.pdffiller.com

Source: www.pdffiller.com

20192024 Form HI G26 Fill Online, Printable, Fillable, Blank pdfFiller, An employer’s guide on state income tax withholding requirements including who must. This takes into account the rates on the state level, county.

Every 2024 Combined Rates Mentioned Above Are The Results Of.

How income taxes are calculated.

4.0% For Properties Between $2 And $10 Million;

Find your pretax deductions, including 401k, flexible.